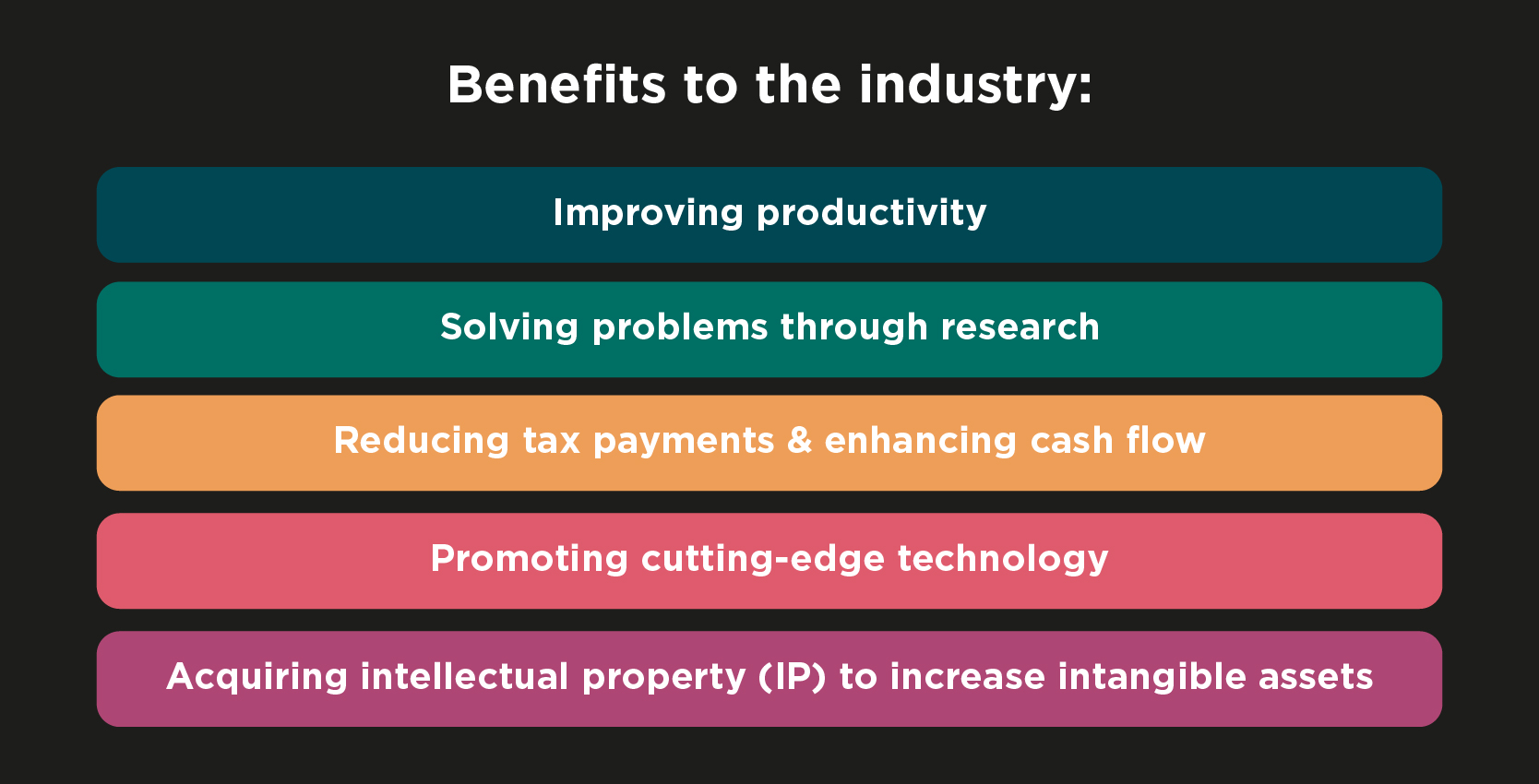

CREAM has achieved Approved Research Institute status from the Ministry of Finance (MOF) under Section 34B of the Income Tax Act 1967.

Double Tax Deduction (DTD) Opportunity

Any person or company contributing to CREAM is eligible for a Double Tax Deduction (DTD). This applies to cash contributions for research activities and payments for research services.

CREAM invites construction companies and individuals to discuss the potential of enjoying DTD. Your research grants can foster collaboration for mutual industry benefit and build a future of innovation together! Contact us to explore possibilities.

For more info and enquiries: www.cream.my/double-tax-deduction